Corporation Tax Company Tax Computation Format Malaysia

The btc is not designed for use by investment holding companies.

Corporation tax company tax computation format malaysia. Basic format of tax computation for an investment holding company pdf 497kb basic format of tax. Examples of direct tax are income tax and real property gains tax. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. A company with paid up capital less than rm2 5 million is required to submit form cp204 within the first year.

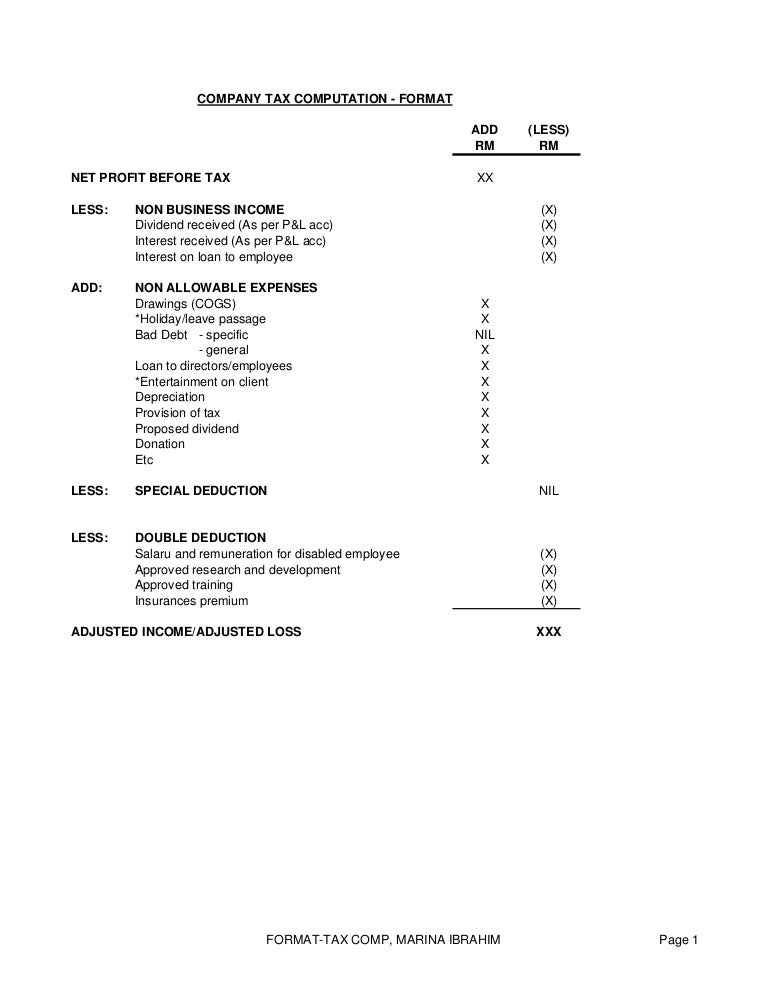

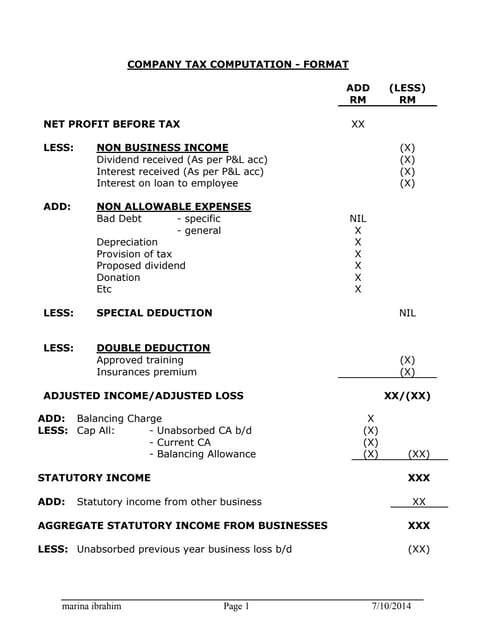

Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia. This page is also available in. Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add.

Malaysia corporate deductions. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x. You may refer to the following templates for guidance on how to prepare your tax computation for specific industries. A direct tax is a tax that is levied on a person or company s income and wealth.

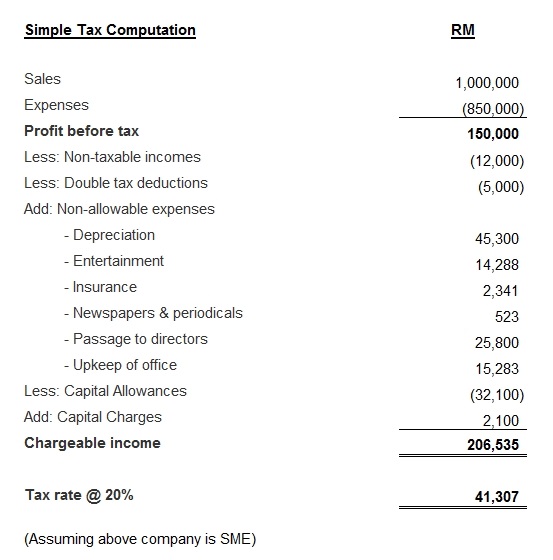

The tax is paid directly to the government. Basic formats of tax computations. The tax requirements for new company are as follows. Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia.

Company tax computation format 1. Company tax computation format add less rm rm net profit before tax xx less. Malaysia s corporate tax system is a significant contributor to the country s economic development. A company is required to furnish tax estimation form cp204 for the coming year to inland revenue board income tax department or lhdn within the first 3 months after the company has generated first sale.

The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. This article provides an overview of corporate tax in malaysia and what it does for the country. Investment holding companies should refer to the basic format of tax computation for an investment holding company pdf 540kb.

Any dividends distributed by the company will be exempt from tax in the hands of the shareholders. This is because corporate tax money is among the malaysian government s primary income sources.